Here’s a little statistical analysis for you, courtesy of NAR. First is a chart comparing rates of homeownership by age group in 2004 with the second quarter of 2010:

The blue line is the 2004 rate, the green is 2010 and the yellow is the % difference in the two. What’s important is that homeownership has declined for every age group since 2004 with the biggest decline occurring in the under 35 group. The good news: there’s a whole lotta folks out there who NEED to buy a home!

The blue line is the 2004 rate, the green is 2010 and the yellow is the % difference in the two. What’s important is that homeownership has declined for every age group since 2004 with the biggest decline occurring in the under 35 group. The good news: there’s a whole lotta folks out there who NEED to buy a home!

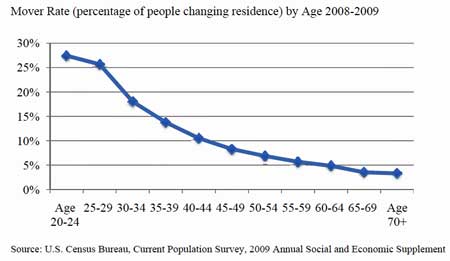

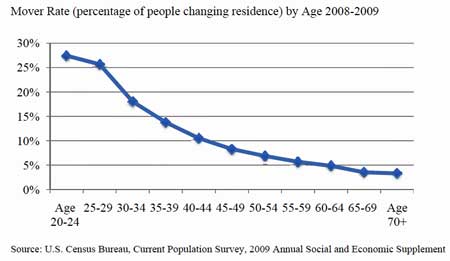

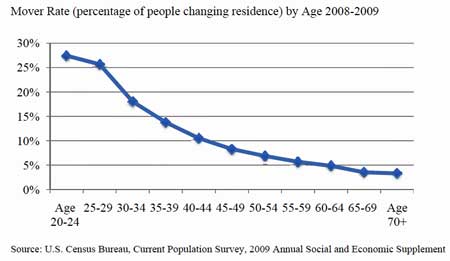

Here’s another graph, this time from the Census Bureau. It’s showing the ‘Mover Rate’ — which tells us who’s moving around out there. Again, it’s the under 35 set that’s moving the most. They are running around like chickens with their head cut off when what they should be doing is so simple: buy a home!

Finally, here’s a non-comparative graph showing rates of homeownership, again by age:

Finally, here’s a non-comparative graph showing rates of homeownership, again by age:

Again, it’s that under 35 set that has the greatest need.

Again, it’s that under 35 set that has the greatest need.

So, it’s younger people who are moving around the most, who have the greatest NEED to buy, but who are pulling back from homeownership at a faster rate than anyone else! And all of this is happening at a time when interest rates are very low and housing is more affordable than it’s been in decades.

I sniff a sales challenge here. What are we saying to the under 35 set to get them interested in buying real estate? What should we be saying? Does the old rent vs. buy analysis still work? Or is it old hat? What’s it going to take to get these folks off the fence and back into the market?

I also believe it’s time for young people to step up and take responsibility for this mess! Clean it up! Young people: it is your DUTY to get out and buy a home this week. You don’t just owe it to yourself, you owe it to your ECONOMY! Personally, I think each of us should go out and find someone under 35 and just smack them! It’s all their fault!

Since I’m part of the “under 35” group I might be able to shed some light on the challenge here. There are a couple things you’ve got to remember about this group. First, those who are qualified to buy in this group, but have not bought recently are likely waiting for some sign of economic stability. My wife and I decided to cut expenses back in 2007 and fortunately we were able to sell our home, unfortunately we made the decision to jump into another home rather quickly because we thought there were some great deals out there and rates were good, and they were. I wish however, I had been a little more patient to buy another home – truth of the matter is I would have saved about $50,000 on the mortgage and cut 1.5% off the interest rate (without having to refinance). I suspect, many younger buyers are slightly more savvy then the “average” buyer today and are playing the waiting game. Secondly, the market is a confusing place. There are lots of tools out there for buyers today. There are tons of websites like Trulia, Zillow, Realtor, Sikku, Listingbook, and countless other franchise and independent broker sites all with information about market conditions, interest rates, and buying challenges. Many times these sites offer conflicting, inaccurate and incomplete information, thus clouding and confusing the decision about whether or not it’s REALLY a good time to buy. Even the most savvy and educated buyer can be overwhelmed at the amount of information out there. So what does this mean for the “under 35” buyer today? Well, first of all, I think it means some of us are going to wait, no matter what you say. There’s just too much negative and confusing information out there. On the bright side, I believe there’s even a larger “under 35” group that’s on the fence. These are people both capable and qualified however, they are still confused. So, the sales challenge to everyone out there is twofold.

First, you’ve got to be able to cut to the chase with regards to the information that’s out there. You need to remind these buyers that they are buying long term. That historically, real estate has been a great investment. Remind them that, in most cases, they are buying this home to start or raise a family. It’s a long term strategy on getting a return on their capital investment. Besides that, they’re likely never again going to see interest rates as good as they are right now today. Many people in their 50’s, 60’s and 70’s who have been in real estate their whole lives have never seen rates as good as they are today.

Secondly, you have to know HOW to communicate and CONNECT. Ask yourself the question “how can I best interact with someone under 35 today?” As much as some of you hate to hear it, the answer is social media. People want to do business with someone they trust right? They want to do business with someone they connect with, right? They want to do business with someone that “speaks their language”, right? They want to do business with someone that understands their concerns and addresses their issues, in a forum that they’re comfortable with. Guess what, it’s called Facebook. It’s called Twitter. Together these two sites make up the bulk of the social media category. It’s where your buyers are spending time connecting, talking, communicating, sharing, networking and even learning. It’s where you’ve got to be if you want a chance at getting your message to the right people, at the right time. We all would agree buyers are critical to successfully closing deals today. We all should agree now, that the “under 35” group is probably the single largest opportunity today. And hopefully, we can all see that getting your message to this group is critical to capitalizing on the opportunity ahead.

Come over here, Ron, I need to smack you. Actually: thanks for the insight. I believe you’re absolutely right. So, would some graphics illustrating how real estate has performed historically over the long haul help? How about one showing the tax benefits of home ownership? Or do we just need a seniors’ guide to using Facebook? (Thought we already had that, thanks to Tami Patzer).

James,

Yes. I think cutting to the chase relating to the benefits and advantages is a great idea. Graphics, metrics, tables and charts are all well and good. Showing the long term benefits and advantages of home ownership not only on the long haul, but short term as well, is often overlooked. Things like, obtaining credit cards, getting auto loans and even getting a job all can be easier as a homeowner. Just look at many credit applications! There’s a reason why more often than not there is a question asking about home ownership. It’s because typically home owners are more credit worthy! Likewise, defaulting to the Jack Bailey approach of showing in detail the CASH FLOW advantage can speak to ever buyer (especially, but not just the “under 35” group!) Who doesn’t want to get more money back at the end of the year from good ol’ Uncle Sam.

Hey – Matt Kellam just shared this and I think it’s exactly what we were looking for: http://online.wsj.com/article/SB10001424052748703376504575492023471133674.html?mod=WSJ_RealEstate_