With the Fed raising interest rates for the first time in almost a decade this week, there are a lot of questions about what it means to home buyers. People want to know how much that kind of increase might impact their anticipated mortgage payment and how much it might affect the amount they can borrow. I’ll attempt to give some guidance in those areas in this post.

First, understand that this is a tiny increase. The Fed didn’t want to shock anyone. They wanted to signal that we are beginning a period of gradual increases. Most experts believe we will experience several small increases in the rate during 2016, which should be a motivating factor for anyone thinking of buying. Every time the interest rate inches up, so do anticipated mortgage payments; and as payments rise, the amount one can borrow decreases. Add to this the fact that prices are slowly rising and soon many may find themselves priced out of the market.

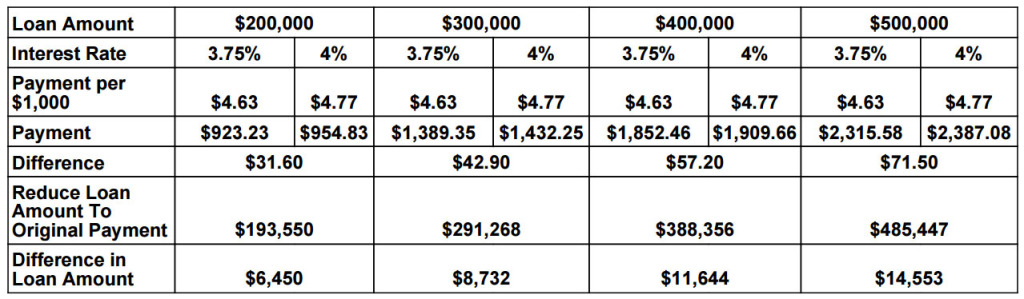

1/4% is not much; but to give you an idea about how this small bump up affects payments and the amount you may be able to borrow, I prepared the following chart. You can see just how small the increase is: at 3.75% interest, a 30 year fixed rate mortgage costs $4.63 per month per thousand borrowed. At 4% it is just 14 cents higher, $4.77 per thousand borrowed. I’ve shown the principal and interest payment at 3.75% and 4% for 4 different mortgage amounts and the difference. You can see that a $500,000 mortgage will cost $71.50 more per month after a 1/4% increase in rates.

Continuing with that $500,000 example: what if the $2,315.58 payment at 3.75% was the most you could afford? What if the increase in rate meant you needed to decrease the amount borrowed to keep that original payment? That’s what’s on the next line down: $485,447. So if you were looking at houses based on a $500,000 mortgage (probably in the $650,000 – $700,000 price range), this little 1/4% bump in rates may have cost you $14,553 in purchasing power!

I realize the type is a little small but if you’ll click on the chart, it will open in a larger view.