Although the initial press releases from FHA about 2010 changes made no mention of limits to seller contribution, yesterday’s release made that part clear. In a nutshell, here are the changes:

- Downpayment requirements increase for borrowers with 580 FICO scores or less from 3.5% to 10%

- Up front Mortgage Insurance premiums will increase .5% to 2.25%. FHA will continue to allow the up front fee to be financed.

- Seller contributions will be decreased from 6% to 3%. In the past, sellers were able to pay up to 6% of a buyer’s loan and closing costs. In the new world, they are limited to 3%.

The changes are in response to pressure from Congress to bolster the soundness the FHA reserve fund and to reduce risk by ensuring that borrowers have ‘more skin in the game’.

I’ve heard from, well . . . nearly everybody how numbing these changes will be to the housing recovery that is taking place today. The economy has created a great market for first time buyers to own their own homes . . . and suddenly we’re making it very difficult for them to take advantage of the opportunity.

Think about it. Today, a young family with less than perfect credit can get into a $150,000 home on an FHA loan with something like $6,000 in cash. That would be enough to cover the downpayment, and some miscellaneous costs. Much of their closing expense can be paid by the seller — up to 6% of the mortgage amount. With the changes, the same family would probably face a 10% downpayment plus have to pick up half of what the seller used to be able to pay for them. That same $150,000 home would probably take $20,000 in cash to acquire. You can imagine how many homebuyers will be taken out of the market when these changes take effect.

We’ve wrestled and wrestled with how to fix the economy and we’ve created new programs to get America moving again, some with positive results, others . . . no so much. I can’t help but wonder what would have happened if we’d have taken a nice chunk of the Stimulus money and put it into housing. What if we’d have made it possible for homeowners to have more — to reduce their debt or their payments — or for buyers to find it easier to get into the market, instead of helping some of the biggest corporations in the world weather the storm.

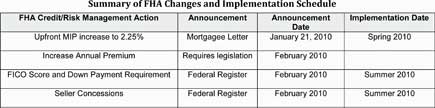

I know these things tend to work themselves out over time and if there’s good news in the FHA changes it is that their implementation is months away. Here is a timeline:

Is there an action step for us here? Probably. Write your Congressmen and Women. Contribute to RPAC, the REALTOR Political Action Committee (they fight not just for the industry, but also for homeowners). Work with your best lenders to find ways to help these newly disenfranchised borrowers get back into the market.

Thanks to Lana Erwin, Help-U-Sell Edmond/OKC, for helping me track down this information.