There is an old Cajun saying that I dearly love: ‘Be what you is; even if you’s old and ugly then be old and ugly, but be what you is.’ The bad grammar is intentional – that’s the way I heard it.

There are many messages in this little line, but this morning what I’m getting is: know your strengths and structure your environment so that you can bring them into play as frequently as possible.

Traditional real estate has generally made a mess out of the salesperson’s job description. Agents are expected to do it all — which means prospect, list, sell, process, coordinate, followup and on and on and on. Truth is: it’s a very rare individual who can do all of that well and all at once. The sharpest quickly zero in on the jobs that result in more listings and more sales and build a team to take on the other functions.

Maybe you’re a great people person. You’re personable, sharp and you know your business. People like to be around you and it seems the more time you spend reaching out to people the more business you do. Maybe technology baffles you. You couldn’t put together a flyer if your life depended on it and you still haven’t learned how to get your email on your Blackberry. Instead of looking over at the Wunderkinds of our industry with all of their devices and technical know-h0w and feeling like you just don’t measure up, find a way to focus on your strength. In this very two dimensional example, the way is clearly to hire somebody to do the largely clerical job of managing your technology (and maybe more). Really: if you are the kind of people magnet I just described, it’s probably a waste of your time and a squandering your biggest asset to futz around trying to keep up with technology when you could pay somebody else to do it for you at $12 an hour.

I got a real lesson in this last week when John Powell and I dropped in on one of our top producing brokers, Patrick Wood, in Chino Hills, CA. Pat’s been in the top five consistently and has closed 44 sides in the last 3 months. He has among the largest market shares in his area and personally outperforms entire offices of traditional agents. Getting a moment with Pat is not easy because his typical day is non-stop meetings, back-to-back , all day long. He’s doing what he’s good at: Pat is definitely a people person. Sitting just outside his office door is his assistant, Valerie. You know the instant you meet her that this person is supremely well organized. Her work-space is neat and everything seems to have its place. The morning we dropped by I commented on the stack of offers she had open before her. ‘That’s 18 offers that came in on one of our REO listings, ‘ she said. I bet she could easily tell you the essential details of the best 5 at the drop of a hat.

John and I had been with Pat for about 30 minutes when Valerie came to the door. ‘Your 10:30 is here and don’t forget, you’ve got an 11 O’clock, too,’ she said. The message was clear: You need to wrap this up or you’re going to be running late all day . . . and frankly, nice as James and John are, neither of them is going to buy or sell real estate through you, so get a move on!

This kind of functional partnership is the stuff of greatness. With the right help a good REALTOR can be huge. On the other hand, it’s very hard to find a great REALTOR who has no help.

In the early 90s, I spent a couple of days with Ron Prechtl, one of the top agents to ever work in Granada Hills. He was a people meeting machine and that’s mostly what he did: meet people, let them know he was in the business and collect their contact information. Every time he came into the office, he’d drop a handful of business cards and scraps of paper on which he’d recorded information on the people he’d met on his assistant’s desk. ‘These go on the regular mailing list,’ he’d say and then, pulling a few out, ‘And these go on the hot list.’ His assistant had a pre arranged schedule of mailings for all of Ron’s various prospect lists and one of her most important tasks was to keep it going and keep it growing.

Ron was a pretty sharp guy; but I’ll bet if he had to organize and maintain a mailing list, produce, print and mail letters on a consistent basis and track the results . . . he’d have done less than half his normal production.

I’ll bet he never spent an hour and a half making a flyer . . . someone else did that while he was out meeting five more people.

In today’s real estate world, finding the time to do what you do best can be daunting. If you’re in the business, you’re probably doing Short Sales. The time and detail requirements for this type of business are so demanding that few are really good at it. You could spend hours of your day cranking through this — again largely clerical — job or find someone to do it for you. It doesn’t even have to be an individual on staff. We recently heard a good presentation from the Loss Mitigation Network who will take on that job for you . . . for free.

Is our business changing? Absolutely. Are there more and more new tools, new technologies, new strategies flooding into the industry? Without a doubt. But people still deal with people and that’s where they usually make the decision to buy or sell: with people. Don’t let your learning curve keep you from doing the thing that has always made you successful: meeting the people. Even if you is old an ugly . . .

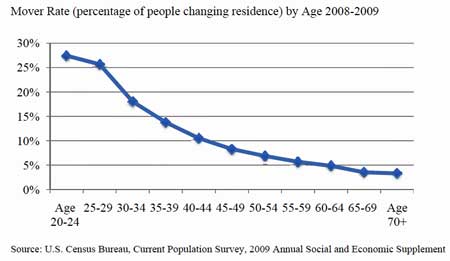

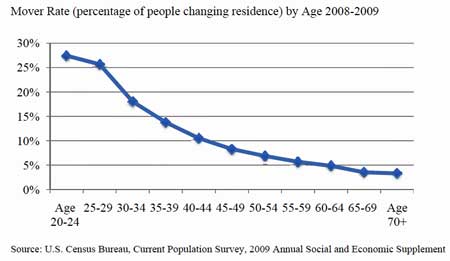

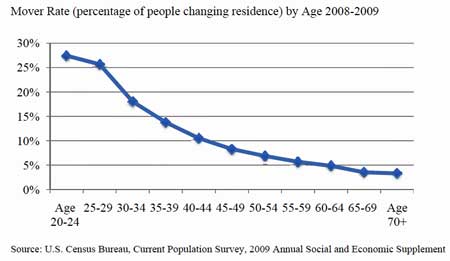

The blue line is the 2004 rate, the green is 2010 and the yellow is the % difference in the two. What’s important is that homeownership has declined for every age group since 2004 with the biggest decline occurring in the under 35 group. The good news: there’s a whole lotta folks out there who NEED to buy a home!

The blue line is the 2004 rate, the green is 2010 and the yellow is the % difference in the two. What’s important is that homeownership has declined for every age group since 2004 with the biggest decline occurring in the under 35 group. The good news: there’s a whole lotta folks out there who NEED to buy a home! Finally, here’s a non-comparative graph showing rates of homeownership, again by age:

Finally, here’s a non-comparative graph showing rates of homeownership, again by age: Again, it’s that under 35 set that has the greatest need.

Again, it’s that under 35 set that has the greatest need.