We are preparing for the National Association of REALTORS convention in New Orleans next month. Help-U-Sell will have a nice booth with a flat screen monitor, internet access and several areas for visitor to sit or stand and talk. Our purpose is two-fold: first we want to use that meeting as our kick-off for Franchise Sales (a business we have not actively pursued in about two years); second, we want to simply announce to the real estate world that we are here and loaded for bear!

Part of the preparation has been to get our marketing material in order and there is a new large format Franchise Sales brochure. It’s not really new; its an update and an Americanization of a great piece Robbie used in South Africa. There’s also a neat new tri-fold describing our technology, websites and tech training. I’ve been putting the finishing touches on four ‘one-pagers.’ Each of these pieces — they are really flyers — describes the benefits of Help-U-Sell from a different point-of-view: that of a Seller, a Broker, an Agent and a Buyer. We plan to share them whenever we talk with a visitor about who we are and what we do.

The flyer idea really started with one of the Pennsylvania Matts. We have two: Matt Kellam and Matt Boyle. One of them — and I’m sorry, I don’t remember which — suggested we sift through the Set Fee Blog and pull out the handful of posts that explain Help-U-Sell in a way that Sellers and potential Agent recruits would understand. The four flyers are what that idea turned into.

I’m going to reproduce the flyers here and provide links where they can be downloaded in PDF form. I’m doing this for two reasons: first – I’m hoping they will be useful to you in your business, but I also want your input on content. What could I have added or said better. These iterations are still in process and will change somewhat over the coming week. When they are finalized during the last week of October, I’ll replace these working copies with finals. You’ll find links to downloadable PDFs below as wellt.

sss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.

So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.

So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.

So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.

So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for SellerDownload a PDF copy of Help-U-Sell for Agents

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.

So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for Seller

Home sellers love Help-U-Sell. Not only do they save with our low set fee pricing, they also experience a freedom of choice in the process that they didn’t know possible.

For us, one size definitely does not fit all, and sellers may opt to go into the MLS (and offer a commission to a selling broker) – or not; to hold their own open houses (thus increasing the probability they will produce their own buyer and save the greatest amount of money) – or not; or to offer a selling fee to the Buyers’ Agents in our own offices – or not. The best part is: no matter what options they choose, in the end, they will pay a fee based on how the sale was made. A seller choosing to go into MLS and offer a co-op commission who then finds his or her own buyer will pay only our low set fee, not the set fee plus the optional fee to the outside broker.

While commissions and Set Fees are negotiable, many traditional real estate firms charge as much as 6% of the selling price. On a 0,000 sale, that could be ,000! With the Help-U-Sell System there are at least three ways a home could sell:

Note: the ,950 Set Fee used in this example is just that: an example. Set Fees vary from office to office and market to market. Set Fees and Commissions are always negotiable.So, what does a seller get for the Low Set Fee? Marketing power (listing on HelpuSell.com and dozens of syndicated sites, signage and inclusion in our ongoing local marketing) along with our negotiating and transaction management skills. Many times this is enough to create a satisfactory sale. Sometimes the additional involvement of the buyers’ agents in our offices and/or the MLS is required. In any case, sellers almost always save over what they’d have to pay a traditional broker to sell their home.

With tightening markets and falling prices, Help-U-Sell makes even more sense today. Our fee model enables sellers to price their property more competitively and retain more of their equity. It’s a great solution!

Download a PDF of Help-U-Sell for SellerDownload a PDF copy of Help-U-Sell for Agentsssss

Download a PDF copy of Help-U-Sell for AgentsDownload a PDF copy of Help-U-Sell for Agentsssss

Download a PDF copy of Help-U-Sell for AgentsDownload a PDF copy of Help-U-Sell for Agentsssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentssssss

Download a PDF copy of Help-U-Sell for Agentssssss

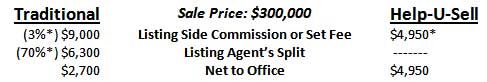

*Commissions, Set Fees and Agent Commission Splits are always negotiable. The above is an example only.

In a nutshell: Help-U-Sell Brokers go into the marketplace with a great Seller offering: Sell your home for a Low Set Fee and save thousands. This strikes a chord with Sellers and they call for information. That’s when our systematic approach to the business takes over and most sellers who contact us eventually list with us. As the Low Set Fee offer generates seller inquiries the listings they create generate leads: more sellers who want to sell and buyers who want to buy.

Unlike traditional offices where whoever’s ‘up’ gets the call (and usually loses the lead), we take great care in how we handle buyer inquiries. The Help-U-Sell office’s job is to capture that inquiry, convert it into a solid lead and pass it off to a buyers’ agent who uses a systematic approach to turn the lead into a client and a sale. Because we take great care with the initial interaction, our Brokers are in a much better position to follow up with buyers’ agents, offer assistance and expect results.

The bottom line is . . . The Bottom Line. When a bold new approach to the real estate business meets a dedicated, entrepreneurial real estate Broker, profitability is almost certain. Best of all, saving people money while making money is a whole lot of fun! Join the quiet revolution!

Download a PDF copy of Help-U-Sell for Brokers

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

*Commissions, Set Fees and Agent Commission Splits are always negotiable. The above is an example only.

In a nutshell: Help-U-Sell Brokers go into the marketplace with a great Seller offering: Sell your home for a Low Set Fee and save thousands. This strikes a chord with Sellers and they call for information. That’s when our systematic approach to the business takes over and most sellers who contact us eventually list with us. As the Low Set Fee offer generates seller inquiries the listings they create generate leads: more sellers who want to sell and buyers who want to buy.

Unlike traditional offices where whoever’s ‘up’ gets the call (and usually loses the lead), we take great care in how we handle buyer inquiries. The Help-U-Sell office’s job is to capture that inquiry, convert it into a solid lead and pass it off to a buyers’ agent who uses a systematic approach to turn the lead into a client and a sale. Because we take great care with the initial interaction, our Brokers are in a much better position to follow up with buyers’ agents, offer assistance and expect results.

The bottom line is . . . The Bottom Line. When a bold new approach to the real estate business meets a dedicated, entrepreneurial real estate Broker, profitability is almost certain. Best of all, saving people money while making money is a whole lot of fun! Join the quiet revolution!

Download a PDF copy of Help-U-Sell for Brokerssss

Download a PDF copy of Help-U-Sell for AgentsDownload a PDF copy of Help-U-Sell for Agentsssss

Download a PDF copy of Help-U-Sell for AgentsDownload a PDF copy of Help-U-Sell for Agentsssss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsssssss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentsss

Download a PDF copy of Help-U-Sell for Agentssssss

Download a PDF copy of Help-U-Sell for Agentssssss

*Commissions, Set Fees and Agent Commission Splits are always negotiable. The above is an example only.

In a nutshell: Help-U-Sell Brokers go into the marketplace with a great Seller offering: Sell your home for a Low Set Fee and save thousands. This strikes a chord with Sellers and they call for information. That’s when our systematic approach to the business takes over and most sellers who contact us eventually list with us. As the Low Set Fee offer generates seller inquiries the listings they create generate leads: more sellers who want to sell and buyers who want to buy.

Unlike traditional offices where whoever’s ‘up’ gets the call (and usually loses the lead), we take great care in how we handle buyer inquiries. The Help-U-Sell office’s job is to capture that inquiry, convert it into a solid lead and pass it off to a buyers’ agent who uses a systematic approach to turn the lead into a client and a sale. Because we take great care with the initial interaction, our Brokers are in a much better position to follow up with buyers’ agents, offer assistance and expect results.

The bottom line is . . . The Bottom Line. When a bold new approach to the real estate business meets a dedicated, entrepreneurial real estate Broker, profitability is almost certain. Best of all, saving people money while making money is a whole lot of fun! Join the quiet revolution!

Download a PDF copy of Help-U-Sell for Brokers

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

*Commissions, Set Fees and Agent Commission Splits are always negotiable. The above is an example only.

In a nutshell: Help-U-Sell Brokers go into the marketplace with a great Seller offering: Sell your home for a Low Set Fee and save thousands. This strikes a chord with Sellers and they call for information. That’s when our systematic approach to the business takes over and most sellers who contact us eventually list with us. As the Low Set Fee offer generates seller inquiries the listings they create generate leads: more sellers who want to sell and buyers who want to buy.

Unlike traditional offices where whoever’s ‘up’ gets the call (and usually loses the lead), we take great care in how we handle buyer inquiries. The Help-U-Sell office’s job is to capture that inquiry, convert it into a solid lead and pass it off to a buyers’ agent who uses a systematic approach to turn the lead into a client and a sale. Because we take great care with the initial interaction, our Brokers are in a much better position to follow up with buyers’ agents, offer assistance and expect results.

The bottom line is . . . The Bottom Line. When a bold new approach to the real estate business meets a dedicated, entrepreneurial real estate Broker, profitability is almost certain. Best of all, saving people money while making money is a whole lot of fun! Join the quiet revolution!

Download a PDF copy of Help-U-Sell for Brokers

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.

First, we put the Broker in firm control: the business is the Broker’s and the Broker is the business. The Broker develops and orchestrates the marketing plan, takes the listings (or has an assistant do this for him), captures and controls the leads and hires assistants and buyers’ agents to help when the flow of business is great enough to warrant. Because the burden of the business is not put on the shoulders of the agents, they work for a reasonable split. Generally they don’t prospect for listings, call FSBOs or Expireds, race to meet advertising deadlines, work on price reductions or do anything associated with the listing side of the business. Their job is focused and manageable: take the buyer leads the office inventory and marketing creates, and convert them to sales. Period.

Because the Help-U-Sell office is organized around systems – a marketing system, a leads intake system, a client management system, the need for the ‘handholding’ of a traditional listing agent is greatly diminished and seller clients are managed by the Broker and his or her assistants. The Low Set Fee offer is so appealing that taking listings is easy, so Help-U-Sell offices tend to have more than their share (and therefore tend to generate more buyer leads).

But, what about those listings? How does a Help-U-Sell Broker charge less and make more. Here’s an illustration:*

Traditional real estate Brokers don’t get us. They know about our fee structure and wonder, ‘How can they charge so much less and stay in business? I’m charging much more and can barely make a profit!’

Help-U-Sell Brokers have discovered the secret to charging less and making more. While the Low Set Fee is at our heart, what makes Help-U-Sell work is bigger than that: it’s a completely different business model.