Hey! It’s Friday! Yipeee! In honor of the perfectly placed day, I am going to recycle a post or two from time to time. This was actually the first post I ever did on the SFB – way back in September of 2009. The truth it contained then is still there today. Enjoy!

My dad was a Broker. I guess that makes me an S.O.B. Son-of-a-Broker. Anyway, I remember the week he passed his first salesperson’s test. It was 1965 and he was so excited. Out came the ‘want-ads’ after dinner and he scanned the real estate section for an opportunity.

Eureka! Ted Tamminga (I’m not kidding- that was his name), the Broker in Avondale Estates a few miles away was looking for a salesperson. My dad went to see him the next day.

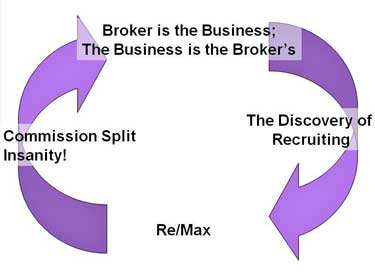

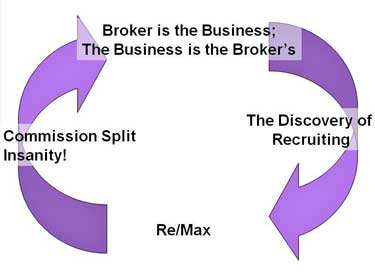

This is where things get interesting, because Ted, unlike the Brokers of today, was not recruiting my dad; he was looking for help. Forty-Five years ago, real estate brokers were community fixtures. The broker was the business and the business was the broker’s. If a broker took on a salesperson, it wasn’t for business expansion purposes. I mean: the broker wasn’t doing it because the new agent might bring new customers the broker didn’t already have. No. He hired agents because he had too much business to handle himself!

Ted saw my dad as an apprentice, to whom he’d toss off the low probability prospects who required much of his time. By hiring him, he could take an afternoon off in the middle of the week to play golf. Dad got the left-overs and the hand-me-downs and was paid reasonably for the good work he did: 50%.

Ted was quite a character. He had the biggest, longest, goldest Cadillac convertible I’d ever seen. He also had a collection of pastel colored polyester leisure suits that would make Johnny Carson jealous. But what I really remember about Ted was the sunglasses — always on — and the huge grinning shark smile. He was just gonna eat you up.

By the time I’d gotten my license in 1976, my dad had done what good salespeople did. He’d developed his own legion of loyal former customers and, being too busy for any more of Ted’s hand-me-downs, opened his own office. I went to work for him.

It was an interesting time in real estate. The franchises were just coming on the scene. Red Carpet was first and showed everyone it could be done. But the big gorilla was Century 21. We’d heard about the company that was taking over the business in California and we heard it was coming our way. When it arrived, we quickly jumped on-board. Why? They offered survival.

We’d watched as some of the Ted Tammingas in our little universe realized that every time they hired an agent, their business got bigger. We’d watched as they added and added and their signs became more and more plentiful. Suddenly we were no longer the comfortable community real estate company. We were just the little guys and it was hard to compete with our more rapidly expanding local brokers.

Century 21 offered a way for the little mom-and-pop brokers to unite under a common banner and appear to be even bigger than the big local independents. That was worth the fare for the first few years, but then it became clear that even under the Century 21 umbrella, the best rewards went to the biggest offices. The franchisor — in fact all real estate franchisors — realized that the most important thing they could do is to teach their franchisees how to recruit.

That was big. The whole industry changed in a couple of years. The broker bulls-eye shifted from doing an excellent job listing and selling real estate to recruiting as many agents as possible. It was the moment when brokers got out of the real estate business and into the recruiting business.

And it worked beautifully . . . for awhile.

Then, in the mid-80s, a tsunami washed over the industry and took it to its knees. The tsunami was Re/Max and its power was the 100% commission concept. Dave Liniger and his team realized that, since the bulls-eye was on recruiting agents, and since many agents are motivated almost entirely by money, if they could find a way to pay them more than anyone else, they’d get ’em all! And ya’ know what? It worked.

Productive agents went to Re/Max in droves and there was little the traditional broker could do but stand in the door of his office and wave goodbye. By the end of the decade, the survivors had started monkeying with the model to cope in the new Re/Max universe. Graduating commission splits started to graduate higher and higher and broker profits sunk lower and lower.

That was pretty much the story up to the market collapse in 2006. It got beyond crazy. In the best real estate market in history, most brokers were making no money. They had to throw it at their agents to keep them from going down the street. Here in San Diego, new agents with no experience at all were routinely offered 80% splits!

While the industry was careening out of control there was a quiet little revolution brewing a few blocks off Main Street. A gentleman named Don Taylor started charging a set fee to market homes — and the fee was way less than a standard percentage based commission! — and he was getting his sellers to help by showing their own property and holding their own open houses. He carefully orchestrated a marketing program that kept the phones ringing with prospective buyers and at the end of the day was able to turn huge numbers of transactions with very little help, amass a legion of delighted customers, and realize a staggering profit.

That was 30 years ago; and while the history of Help-U-Sell is a jagged line on a piece of graph paper –wild rises and horrendous crashes — the brand has endured. Remarkably, it’s changed very little from Don Taylor’s original vision. It still puts the consumer first and the broker in the center. It still delivers on the promise of seller savings over typical commission models. And it still delivers great profits to the broker.

Today we are in real estate purgatory. We’re paying for the excesses of the first five years of this millennium. Agents have exited the business in droves (this is a good thing), and those who remain are working harder than I’ve ever seen agents work in my life. Prices are falling, interest rates are low, yet despite great government incentives, it’s hard for people to buy today. Financing requirements are tough, time-lines are longer and there’s lots of uncertainty around every corner. It’s a simmering soup of conflicting forces struggling to find a way out of the cauldron.

Here’s a great business truth: you don’t make huge market share gains in the good times. The market share battle is won in times like these, times of crisis, times of chaos. As we emerge from this, the consumer is going to be making a choice about which real estate companies he wants to see in the future. He’s got lots of baggage. He remembers the huge commission expense that showed up on the HUD 1 last time he sold. He has gained access to much of the information brokers and agents kept from him in the past. And he’s learned from the banking business and the stock brokerage business and the travel business that he’s able to do a lot of things on his own, without the help of a knowledgeable expert.

I don’t think he’s going to be choosing one of the Big Five (or Six or Seven — it doesn’t matter: they all have the same tired, agent oriented model). He’s going to be making a new choice, one that fits in the new world of empowered consumers. This is going to be fun!